Neighborhood Assistance Program

The Neighborhood Assistance Program was created by the General Assembly in 1981, to encourage businesses, trusts and individuals to make donations to approved 501(c)(3) organizations for the benefit of low-income persons.

Waynesboro Area Refuge Ministry, Inc (WARM) is currently distributing 2023-2024 State Tax Credits from the Virginia Department of Social Services’ Neighborhood Assistance Program (NAP).

How NAP Works

Under this program your contribution to WARM may be eligible for Virginia’s Neighborhood Assistance Program (NAP) tax credits. NAP offers Virginia state income tax credits to individuals and businesses who give to WARM through the program. The eligible individuals and business who make charitable contributions to WARM receive tax credits to reduce their state tax bill at 50% of their donation value.

| DONOR TYPE | MINIMUM DONATION | ELIGIBLE DONATION TYPE |

| Individual | $500 | Cash or Marketable Securities ($125,000 max gift) |

| Business | $616 | Cash or Stock (services, real estate, rent/lease gifts considered) |

Examples

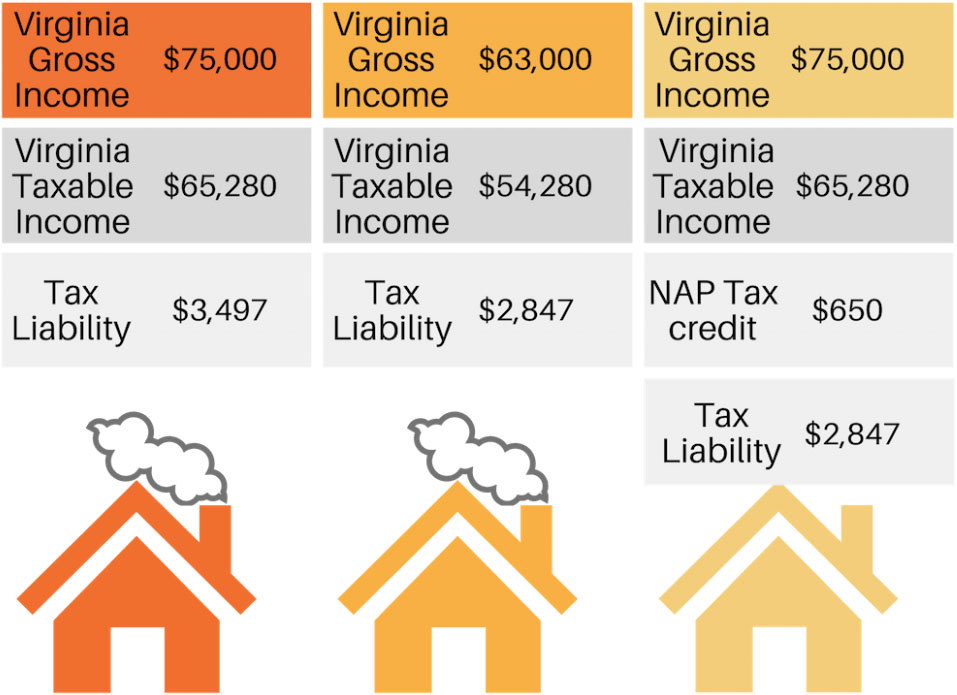

The below examples are hypothetical in nature. Some utilize the maximum credit percentage rate of 65% as an example so please note that WARM distributes credits at the allowed 50% rate. Household tax rates and tax credit benefit vary per household and specific tax circumstances. Please consult your Accountant or Tax Adviser to learn how a NAP gift to WARM will benefit you specifically.

Benefit Example #1

Tax Savings: (this example uses non-AMT taxpayer at 35% Federal rate with the max tax credit rate of 65%; please note that WARM distributes its tax credits at the 50% rate to help meet the organizations annual individual & business budget goals and maintain a diversified income approach).

| Donation Amount | $1,000 | $2,500 | $10,000 |

| Federal: Tax deduction for contribution @ 35% rate | $350 | $875 | $3,500 |

| Virginia tax credit – at 65% | $650 | $1,625 | $6,500 |

| Less: reduction of federal itemized deduction for VA tax | -$247.62 | -$619 | -$2,476.25 |

| Total Tax Savings | $809.88 | $2,024.75 | $8,098.75 |

| Net cost of contribution | $190.12 | $475.25 | $1,901.25 |

Benefit Example #2

The second example shares the benefit received by a household with an annual income of $75,000. A gift of $1,300 (cash or stock value) reduced the household’s tax bill to the same as a household with an annual income of $63,000. The donor receives the dollar for dollar value of the tax credits (50% of gift value) and still receives the additional tax benefits from donating to a charity.

WARM’s NAP Tax Credit Process

1) Decide on your gift amount, download and complete applicable CNF Form AND Credit Adjustment Authorization Form found on this page. The Eligible Tax Credit is valued at 50% of the donation subject to the following criteria:

- Individual Donor – $500 minimum cash or marketable securities donation

- Maximum tax credit/married couple = $50,000

- Business Donor – $616 minimum donation

- Maximum individual tax credit = $125,000

2) Submit your gift and 2 required NAP forms by mail to the WARM office in person or by mail (if giving online or with stock/marketable securities then please be sure to mail or drop off completed CNF and Credit Adjustment Forms for your gift to be processed).

3) WARM receives your donation and accompanying paperwork and internally acknowledges gifts from donors.

4) Once the gift and all forms are received, WARM certifies the CNF and submits it to the Virginia Department of Social Services (DSS) for review and approval.

5) The donor receives Tax Credit Certificate for current tax year by mail from DSS (typically 6-8 weeks from DSS receipt).

For assistance or questions call the Administrative Coordinator during business hours at WARM’s office at 540-324-8166.

With a direct stock donation to [WARM], the donor’s federal income taxes are reduced by an additional $13,960 and the charity receives $10,000 more (assuming investment has been held for more than a year) See Helpful Links #3 for source and details.

Online donations are eligible for state tax credits via the Neighborhood Assistance Program (NAP) . If you donate online for this program, please share that it is a NAP gift in the notes in your gift details.

You also may mail your NAP contribution to: WARM, 1035 Fairfax Avenue, Waynesboro, VA 22980, Attn: NAP Credits. Be sure to include the signed CNF Form and Tax Credit Adjustment Form with your gift for timely processing (forms are located at left).

Non-cash business donations (stock, merchandise, real estate, leased space, certain professional services) must be pre-approved by WARM and valued in accordance with NAP and IRS standards.

To qualify, NAP donations must be made directly to WARM with no strings attached and without any conditions or expectations of monetary or other benefits. Discounted property, partial donations or bargain sales are not allowable for NAP donations.

The value of tax credits is computed based on 50% of all donations (up to maximum)received between either July 1 through December 31 OR January 1 through June 30 of each calendar year.

Individual donors CAN claim their Federal deduction for donations for which they have received a Virginia State income tax credit.

An individual is limited to a maximum donation value of $125,000, per year. Currently, there is no maximum donation limit for a business or trust. It is advised to always consult with your accountant or tax adviser when giving a gift that you have specific tax liability and benefits questions about.